Today, remitting operations are in high demand among users worldwide. People are searching for safe and fast ways to transfer funds internationally. It is essential to pick sides with the trusted banking institution or its alternatives for this purpose first. Filipinos and those who have resident permits in the Philippines prefer Metrobank for immediate remittance from the sender to the recipient.

This financial organization is one of the modern and digital-friendly ones to take into consideration if sending money internationally is required. But for the smooth remitting activities the relevant Metrobank SWIFT code is needed. Senders often try to find banking identifier patterns as well. The relevant Metrobank SWIFT BIC codes are necessary if any of the local branches of this financial establishment is specified by the recipient.

But first, take a closer look at all the strengths and weak spots Metropolitan (MB/Metro Bank) can offer for its account holders and those who undertake wire transfers via the SWIFT network to relatives, friends, and other users abroad.

What Is MB & TC (Metropolitan Bank & Trust Co.)?

Usually, consumers call this banking establishment Metro Bank. But its full name well-known among Filipinos and residents of other countries is MB & TC (Metropolitan Bank & Trust Corporation). Compared with other similar financial organizations, it is notable for its pretty digital-friendly and customer-centric platform with various online features.

All the issues are solved timely due to the round-the-clock customer support available in the form of live chat and operators’ callbacks. Managers keep in touch with the consumers within several minutes after the last request. Due to the 24/7 mobile support, almost every question is solved immediately.

Users do not face new challenges related to exchanges, their accounts, savings, and other situations of their interest thanks to the detailed helpdesk available in the application and on the official website. Most banks do not offer the table with character sets used for SWIFT-driven international operations. But here you can find the relevant BIC code for Metrobank easily.

Among other strengths to consider while speaking about renowned MB & TC in the Philippines are:

- Available in-person banking options with customized rewards;

- Extended opening hours for local customers;

- Accessible limits for deposit cash-outs that are free of charge (only 0.7% of the deposit sum cashed out is a fee for limit overdrafts);

- Zero monthly fees for business account holders (in case the balance is positive and is above the threshold);

- Affordable monthly charges for business accounts (about $5 per month) if the threshold is higher than the current account balance.

The annual charge for the business credit card holding is about $15. This fee is even lower than average other financial institutions offer. Affordable charges for business loans also take place (starting from 4.5% annually). It can be seen as a solid business-centric approach of this banking institution with the same focus on average individuals who hold accounts there.

What Weak Spot Metro Bank Is Notable for?

But some weak spots also should be taken into consideration. For example, the number of ATMs is nearly 600 in the Philippines. Almost all of them are presented in the local branches. It is almost impossible to access the ATM independently from the physical office which usually closes at 4-5 P.M. on working days and does not work on weekends.

It means that those who are searching for the relevant SWIFT code for Metrobank in the Philippines should inform the recipient about this challenging situation. Both local branches and ATMs are accessible on working days and on local banking hours (from 9.00 AM and up to 4.30 PM on Mon, Tue, Wed, Thu, and Fri).

Among other unfavorable conditions for most consumers globally MB & TC is notable for are:

- Poor wealth management options available in the app;

- Lack of sustainable business services;

- Poor physical international presence as the remitting service provider.

But speaking about unique features that allow Metro Bank to stand out among competitors in the niche, it is worth mentioning the focus on innovations. VIP customers can opt for extended banking hours in some local branches.

There is a pretty qualitative accounting software integration for consumers’ personalized cash flow management experience. There are analytical features on expenditures and savings accessible in the application.

Why Do Users Need SWIFT Code for Metrobank?

As can be seen, the average remittance session is impossible without the specific character set the sender uses for the transaction. This pattern contains from 8 and up to 11 digits to verify the operation and be sure that funds will be received by the customer of your interest. Metrobank SWIFT code is also an 8-digit character set as clients of other financial institutions apply for remitting sessions.

Note that this pattern is about the recipient’s payment details. It means that the Metrobank bank code for SWIFT-based remittance contains information about the office/branch to which funds are remitted. The average character set includes abbreviations with the following details:

- Bank;

- Country;

- Location.

Note that only the Metrobank SWIFT BIC code will contain supplementary letters and numbers to specify the branch. That is why it becomes an 11-digit pattern to consider. While summarizing, users need this specific code for money transfers around the globe. The task of the sender is to find the relevant one to make the remittance safe and quick.

Do not confuse the Metrobank account number with the SWIFT/BIC codes. It is not enough to know the recipient’s payment details. You need to use the 8-digit character pattern to remit funds to the required address. For this purpose, explore the Metrobank SWIFT code and BICs for your hassle-free operations with zero risks for the sender and the person you remit money to.

What Is the SWIFT Code for Metrobank to Remit Funds Internationally?

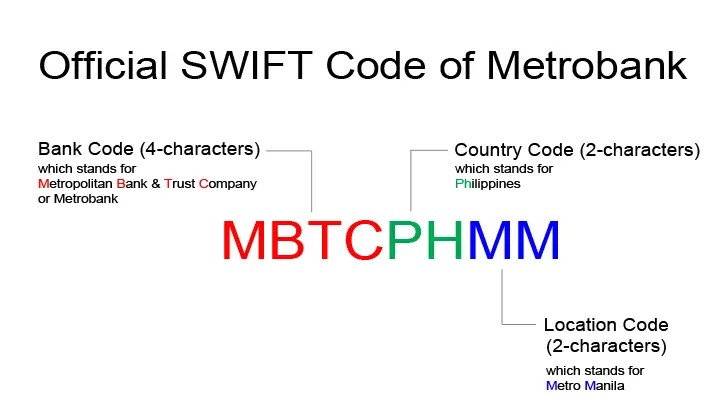

It is an 8-digit character set used for remittances globally. The standard Metrobank SWIFT code contains only letters. This is the pattern with specific abbreviations. Users should specify MBTCPHMM to remit funds to the recipient with the account for cash-outs in the central bank office in the Metro Manilla location.

Let’s understand the sense of each letter presented in the SWIFT code for Metrobank (Philippines):

- MBTC – the abbreviation for the banking institution. This is the official Metrobank bank code (abbreviation for Metropolitan Bank & Trust Corporation);

- PH – this is the abbreviation for the Philippines. This country is presented this way. You can see these two capital letters in SWIFT/BICs of other financial establishments;

- MM – the abbreviation for the location (Metro Manilla). The central office together with most other branches is located there.

This way each digit is explained in the SWIFT code for Metrobank, Philippines. Use it if you are planning the remittance. Check Metrobank SWIFT BIC codes if you are interested in remitting funds to other local branches.

Where to Find the Relevant Metrobank Account Number?

Some people still confuse this character set with the one required for SWIFT-driven remitting sessions. Nevertheless, the Metrobank account number is a 13-digit pattern that can be found on the plastic of the debit/credit/prepaid or other card of this financial institution. Take a closer look at the lower left corner.

Usually, this code is located below the name of the user who holds this card. Additionally, you can find the unique Metrobank bank code (account number) of the card owner on the first page of the passbook.

Where to Find the BIC Code for Metrobank?

The BICs are 11-digit character sets that include three letters (or letters with numbers) to specify the branch of the Metro Bank fin-corp establishment. There are hundreds of physical offices in the Philippines. The best way to find the relevant bank identifier code for your international money transfers is to contact the managers of the branch you are interested in.

In most cases, the SWIFT code is enough to specify for the remitting operations. But some branches obtain unique BICs for funds remitting sessions. Take a closer look at some of them presented in the table below.

|

The Metro Bank Branch in the Philippines |

BIC Code to Consider |

|

METROBANK CARD CORPORATION (A FINANCE CO.) |

MCCEPHMMM1 |

| METROBANK FINANCIAL & EXCHANGE |

MBTCPHMMHON |

| METROBANK INVESTMENT & FINANCIAL |

MBTCPHMMD11 |

Summarizing

The best way to remit funds worldwide is to try transactions via the reliable SWIFT network. Residents of the Philippines can get funds from business partners, relatives, and friends this way. Metro Bank account holders should remember the relevant SWIFT code to request a remittance and provide these payment details to the sender. Check BICs if the banking account is served by the local branch with another identifier code.